Discover The Latest Tech

For

Creatives

Content Creators

Innovators

Vibes Maker

Health Guru

Biz Wizard

You

Discover the latest AI tools and innovative products designed to enhance your efficiency and creativity.

FlyFin

Discovered by

Product Review

FlyFin

FlyFin

| 5 star | 0% | |

| 4 star | 0% | |

| 3 star | 0% | |

| 2 star | 0% | |

| 1 star | 0% |

Sorry, no reviews match your current selections

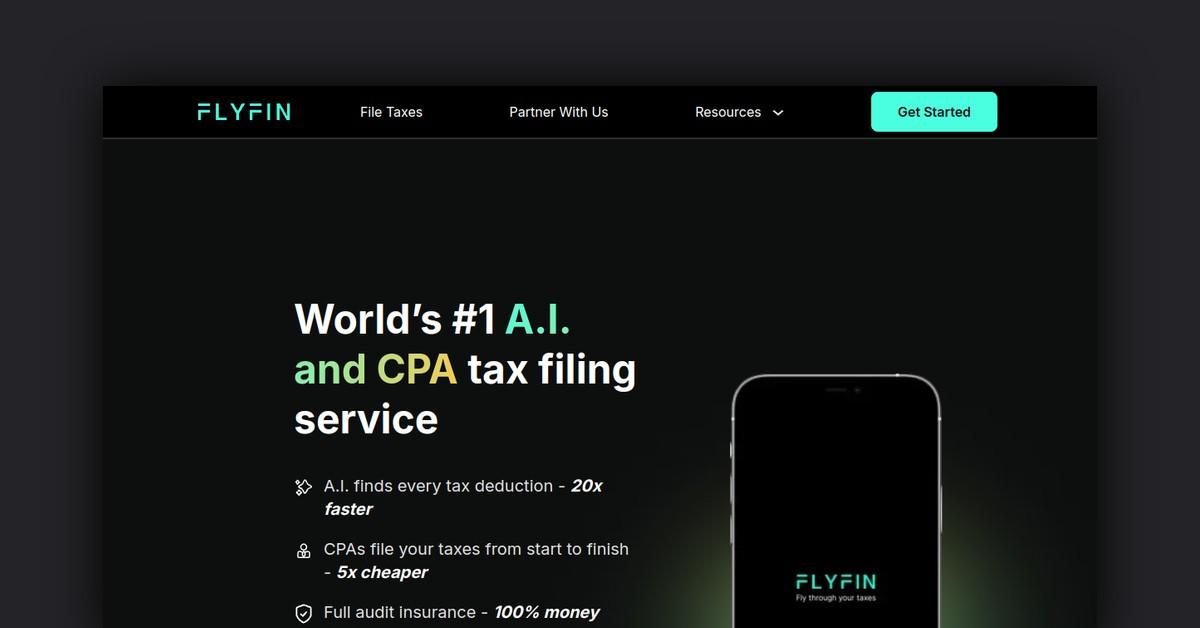

What is FlyFin?

FlyFin is an award-winning tax service powered by artificial intelligence, tailored specifically for freelancers and self-employed individuals. It simplifies the tax preparation process by automating many of the tasks involved.

What Makes FlyFin Unique?

FlyFin leverages advanced AI technology to analyze your expenses and uncover every potential tax deduction applicable to you, significantly reducing the burden of tax preparation by up to 95%.

Key Features

- A.I. Deduction Finder: Automates the identification of all possible deductions, saving users an average of $3,700.

- CPA Review: Ensures 100% accuracy and maximizes savings through expert CPA oversight.

- Quick Online Filing: Complete federal and state tax filings in just 5 minutes.

- Audit Protection: Provides full representation and protection during audits by CPAs.

- Quarterly Tax Calculator: Helps estimate quarterly taxes based on your deductions.

- Unlimited CPA Support: Ask as many tax-related questions as you need and receive answers from certified CPAs.

- Expense Tracking: Monitor your deductions and expenses conveniently from your mobile device.

Pros & Cons Table

| Pros | Cons |

|---|---|

| Automated deduction identification | Focuses only on U.S. taxes |

| Expert CPA review for accuracy | Fees apply after the free trial |

| Quick and easy online filing | Limited to freelancers and self-employed |

Who is Using FlyFin?

FlyFin is ideal for:

- Freelancers

- Independent contractors

- Gig workers

- Sole proprietors

- Anyone seeking a straightforward tax solution

Support Options

- Email and in-app messaging support

- Unlimited tax questions answered by CPAs

- IRS audit protection and assistance

Pricing

FlyFin offers a free 7-day trial. After the trial period, the pricing plans are as follows:

- Basic Plan: $99/year – Includes tax filing and CPA review

- Standard Plan: $199/year – Adds audit protection and additional deductions

- Premium Plan: $299/year – Includes a dedicated CPA advisor

Please note that pricing information may not be up to date. For the most accurate and current pricing details, refer to the official FlyFin website.

Integrations and API

FlyFin seamlessly connects with over 2,000 financial institutions to automatically import your transactions and expenses. Additionally, it offers a developer API for creating custom integrations and applications.

FAQ

- Does FlyFin charge fees for tax filing? Yes, FlyFin charges a fee starting at $99 for tax filing with their CPA team.

- What deductions does FlyFin find? It identifies all common deductions, including home office, mileage, travel, and equipment.

- Can I export data to file taxes elsewhere? Yes, you can export your tax summary in IRS Form 1040 format.

- Does FlyFin support international taxes? Currently, FlyFin focuses exclusively on U.S. taxes.

Useful Links and Resources

For more information, visit the official FlyFin website and explore additional resources to enhance your tax preparation experience.

TL;DR

FlyFin automates tax preparation using AI, making it easy and efficient for freelancers and self-employed individuals to maximize deductions and file taxes quickly. Start your free trial today at flyfin.tax.

Acrostic AI

Craft personalized acrostic poems in seconds with our user-friendly AI writing assistant

HYBRID RITUALS

Our daily rituals are constantly shifting with new technologies emerging.

How do we discover, embrace and use them to our best advantage?

Hybrid Rituals shares about the tools and innovations driving a new era of creativity and lifestyle — we cover everything from AI to immersive worlds, from music technology to 3D-printed fashion.

Discover possibilities that spark revolutionary work and redefine what's possible at the intersection of creativity, technology and efficiency.