Discover The Latest Tech

For

Creatives

Content Creators

Innovators

Vibes Maker

Health Guru

Biz Wizard

You

Discover the latest AI tools and innovative products designed to enhance your efficiency and creativity.

Finbots

Discovered by

Product Review

Finbots

Finbots

| 5 star | 0% | |

| 4 star | 0% | |

| 3 star | 0% | |

| 2 star | 0% | |

| 1 star | 0% |

Sorry, no reviews match your current selections

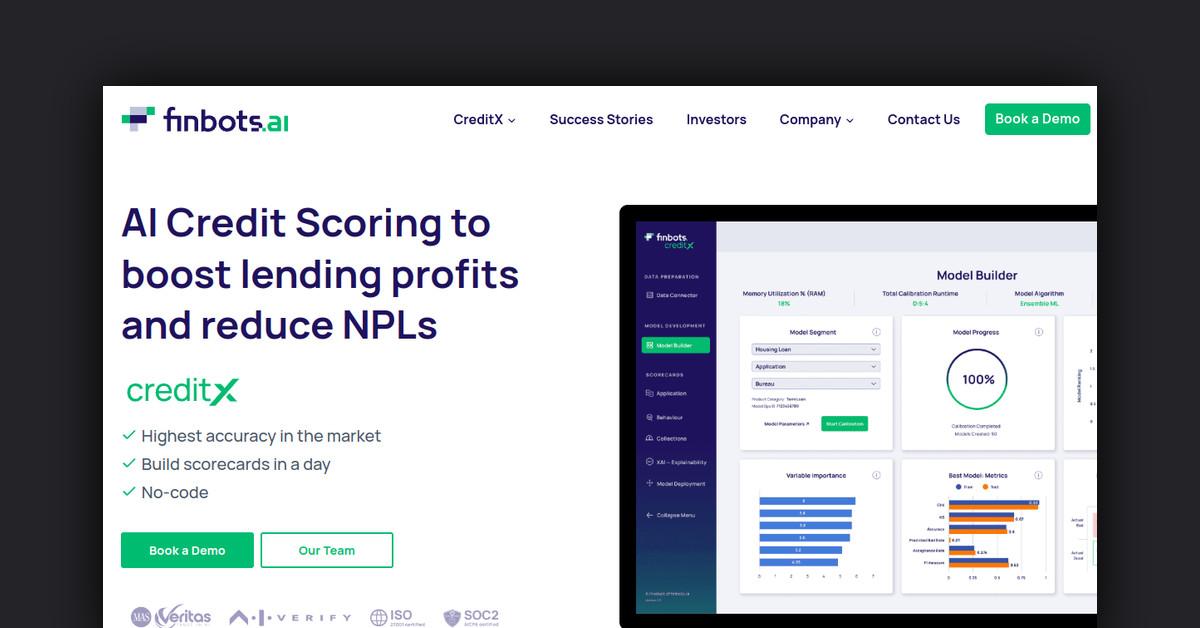

Overview of finbots.ai

finbots.ai provides a no-code AI model builder platform named creditX, enabling lenders to swiftly create and implement precise credit risk models, referred to as scorecards. The proprietary AI algorithms within creditX can process data, engineer features, construct and validate models, and deploy them via API in just one day, significantly reducing the typical timeframe of 9-12 months.

creditX offers application, behavioral, and collection scorecards to facilitate the entire lending lifecycle. The platform integrates with internal, external, and alternative data sources to develop comprehensive models. finbots.ai caters to clients worldwide in banking, fintech, lending, and insurance sectors.

What is finbots.ai?

finbots.ai is an innovative platform that empowers lenders to build and deploy credit risk models quickly and efficiently without the need for coding expertise.

What Makes finbots.ai Unique?

The creditX platform stands out due to its user-friendly design, allowing lending professionals to easily navigate the model-building process. Key features include:

- Data Ingestion: Seamlessly connect and ingest data from various sources with automatic validation and transformation.

- Feature Engineering: Utilize over 100 auto-derived variables to identify optimal variables and non-linear relationships.

- Model Builder: Instantly configure model parameters and generate new models to assess their impact on probability of default (PD).

- Model Validation: Ensure maximum accuracy through cross-validation with proprietary trained frameworks.

- Model Deployment: Achieve real-time decision-making with one-click API deployment.

- Monitoring: Track model performance with built-in monitoring, analysis, and reporting tools.

Key Features

- Speed: Models can be built in just one day, compared to the usual 9-12 months.

- Accuracy: Advanced AI and machine learning algorithms enhance model precision.

- Automation: The entire process is automated, requiring no coding skills.

- Flexibility: Easily adjust models to align with business goals.

- Scalability: The cloud-based platform grows alongside your business.

- Explainability: Gain insights into the factors influencing model decisions.

- Fairness: Algorithms actively work to minimize bias and promote fairness.

- Security: Adheres to bank-grade security and compliance standards.

Pros & Cons Table

| Pros | Cons |

|---|---|

| Rapid model development | Requires initial data integration effort |

| User-friendly interface | Limited customization for advanced users |

| High accuracy with AI algorithms | Dependent on data quality |

Who is Using finbots.ai?

finbots.ai serves a diverse global clientele, including:

- Banks: Regional, national, and multinational institutions of all sizes.

- Fintech Lenders: Digital lenders catering to consumers and businesses.

- NBFCs: Non-banking financial companies.

- Credit Providers: Retailers, telecommunications companies, and others offering consumer credit.

- Insurers: Insurance companies utilizing credit risk models.

- Governments: Agencies providing loans, grants, and credit guarantees.

Support Options

finbots.ai offers comprehensive support options, including:

- Online documentation and tutorials

- Email support for technical inquiries

- Dedicated account managers for enterprise clients

Pricing

Pricing details for finbots.ai’s services are available on their official website. For the most accurate and current pricing information, please refer to the official finbots.ai website.

Please note that pricing information may not be up to date. For the most accurate and current pricing details, refer to the official finbots.ai website.

Integrations and API

creditX seamlessly integrates with various internal, external, and alternative data sources, allowing for a comprehensive approach to credit risk modeling.

FAQ

For frequently asked questions regarding finbots.ai and the creditX platform, please visit the FAQ section on their website.

Useful Links and Resources

TL;DR

In summary, finbots.ai delivers a revolutionary AI platform that enables lenders to create highly accurate credit risk models in just one day. The creditX solution is reshaping how banks, NBFCs, fintechs, and other lending institutions assess credit, approve borrowers, and manage risk. With proven success across leading financial institutions globally, finbots.ai is set to spearhead the new era of AI-driven lending.

Acrostic AI

Craft personalized acrostic poems in seconds with our user-friendly AI writing assistant

HYBRID RITUALS

Our daily rituals are constantly shifting with new technologies emerging.

How do we discover, embrace and use them to our best advantage?

Hybrid Rituals shares about the tools and innovations driving a new era of creativity and lifestyle — we cover everything from AI to immersive worlds, from music technology to 3D-printed fashion.

Discover possibilities that spark revolutionary work and redefine what's possible at the intersection of creativity, technology and efficiency.